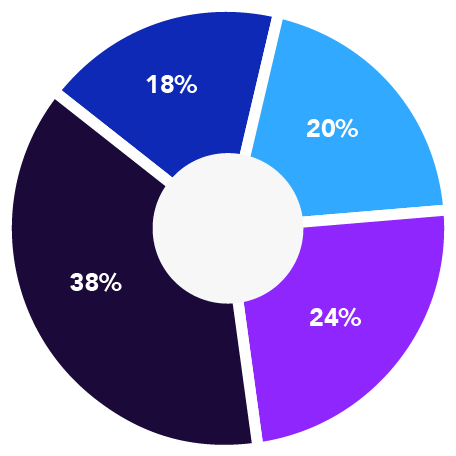

In July 2018, we asked 1,002 buy-to-let investors what they planned to do with their buy-to-let portfolio over the next five years. 44% said they planned to sell some or all of their portfolio. That’s a big change, and suggests that more challenging market conditions – such as increased stamp duty, abolition of the wear and tear allowance and landlords no longer being able to claim tax relief on mortgage interest – are already spreading uncertainty among investors.

Over the next five years, I plan to...

- Increase my buy-to-let portfolio

- Sell all of my portfolio

- Sell part of my portfolio

- Maintain my current porfolio

.png?width=640&name=Report_cover_Octopus-Choice(1).png)